الاثنين، 31 أغسطس 2015

الأحد، 30 أغسطس 2015

US funding Raising activity for 2016 US Presidential elections :Who has raised how much

fgfg

HOW THE BIG 3 IS STACKED AGAINTS EACH OTHER WHEN IT COMES TO FUNDING RAISING Donations To 2016 Presidential Candidates, By Size Percent of candidates’ committee and superPAC donations from different donor groups. Charts are ordered by amount of money raised (largest to smallest — that is, Jeb Bush to Lincoln Chafee).

Fund Rausing Campaigns in US : Who Has Raised how much and how

The 2016 US presidential elections candidates have already raised more than $350 million combined. In comparison, the two political parties in the U.K. raised less than $13 million over their entire 2015 election. The staggering U.S. campaign fundraising totals come from three primary sources: campaign committees, super PACs, and other committees (including nonprofits like 527 groups).

Fund Rausing Campaigns in US : Who Has Raised how much and how

the best cities to work for for marketing and sales professionals

California, Pennsylvania and New York are the top 3 states which pays the highest salaried to sales and marketing professionals.

The above chart shows the best locations for sales and marketing employees" who are most likely to get more than average compensation" as compared to other cities in USsource : salaries.startclass.com

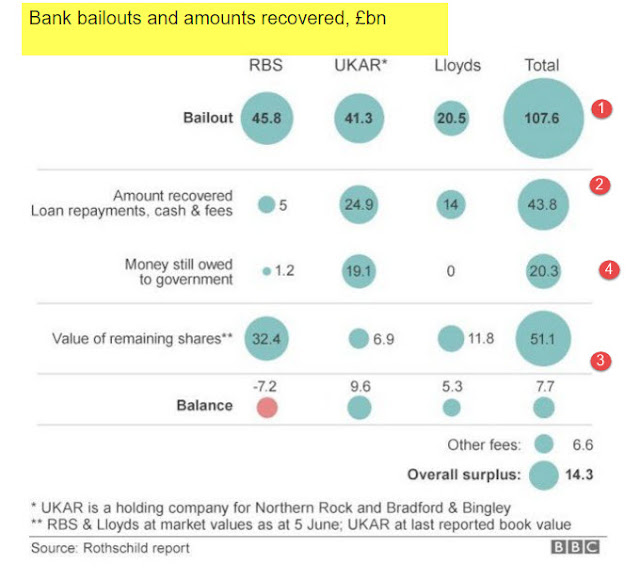

Bailout of Top 5 Banking Companies by UK Government

The UK government plans to sell its 80% stake in the Royal Bank of Scotland.

This chart takes a look at how the UK government has paid in terms of government bailout and how much it has got backk

But how much has been paid in bank bailouts and how much has the government got back?

the most popular emarketing automation tools for IT Enterprises

Bain Capital

- Year in which it was Founded :1973,

- Number of full time employees : 900+

- Investor capital Bain manages as of date : :$75billion

- Bain Capital was founded in 1984 by Bain & Company partners Mitt Romney, T. Coleman Andrews III, and Eric Kriss,

- Bain Cap specialises in : private equity, venture capital, credit products

- Investments across industries :Bain Capital invests across a range of industry sectors and geographic regions.

- Bains Total Assets: $66,000,000,000

- Initial Investment Funding Raised $37,000,000

- Earliest Bain's investment : earliest and most notable venture investments was "Staples, Inc., the office supply retailer.

- Bains acquisitions and investments : Along with Thomas H. Lee Partners, acquired Experian, the consumer credit reporting business of TRW Inc., in 1996 for more than $1 billion.

الجمعة، 28 أغسطس 2015

الخميس، 27 أغسطس 2015

Apple's 9th september event rumored to unveil 4 inch iphone and apple TV

Get ready to welcome back Apple's keynote come september Apple’s upcoming iPhone event is taking place on September 9, and the press blitz is coming fast. Howrever for those apple fanatics who felt apple will be unveiling its next hand watch or iweight accessories, a new icar or a new iTV is set for disappointment.

However as it goes with tradition, There would be a launch however as according to Appleinsider while Apple will announce two new iPhone 6 models on stage, there won’t be a 4-inch "iPhone 6c". According to 9to5mac’s Mark Gurman, Apple is retiring the smaller iPhone c product line due to an "aging feature set." The site adds that Apple is working on a new 4-inch phone product, but that it will not be released this year.

Meanwhile new reports from buzzfeed suggests Apple would make some kind of announcement of the new Apple TV. This was originally pegged for a launch in June 2015 during WWDC but was scrapped at the last minute the announcement then.

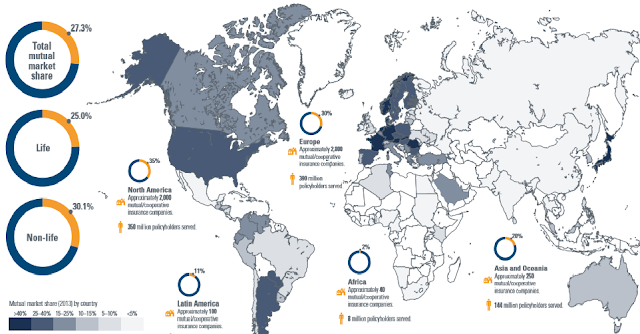

global insurance stands at 6%, S. Africa, S. Korea most insured with 15% penetration

The biggest 10 corporations which has been financially bailed out by US Government

Which American corporations are largest recipient of US Financial Bailout package

Top 10 corporations which has benefitted from the U.S Government. Financial Bailout Package ;

The above chart represents the list of 10 corporations who have been among the receipients of American government sponsored bailouts program.

Heading the list as the biggest recipient of US government bailout is Fannie Mae with a $116 billion bailout package. However government aided bailouts or not, the company has a debt of $22 billion outstanding.The number 2 in the list is Freddie mac with a government bailout package of $71.3billion,,while AIG is no 3 with a total bailout package of

Till date the US Government has bailed out 951 corporations with a total disbursed bailout package amounting to $615B. Out o this $390B were returned back to the Government. The total Total revenues from dividends, interest, and other fees amounted to $283B Total disbursement

.

The above chart represents the list of 10 corporations who have been among the receipients of American government sponsored bailouts program.

Heading the list as the biggest recipient of US government bailout is Fannie Mae with a $116 billion bailout package. However government aided bailouts or not, the company has a debt of $22 billion outstanding.The number 2 in the list is Freddie mac with a government bailout package of $71.3billion,,while AIG is no 3 with a total bailout package of

Till date the US Government has bailed out 951 corporations with a total disbursed bailout package amounting to $615B. Out o this $390B were returned back to the Government. The total Total revenues from dividends, interest, and other fees amounted to $283B Total disbursement

.

kentuck, michigan and Indiana tops increase in car insurance on speeding

States with the Biggest Car Insurance Rate Increases Post-Speeding Ticket | Credio: South carolina kentuck, michigan,vermont, winsconsin and Indiana tops increase in car insurance after a speeding ticket. While Wyoming increase in insurance rates after speeding is a mere 3% and lowest among all american states

which US states pay the highest average salary to MBA graduates

How starting salaries at America's Business Schools differ by regions .The Chart shows the geographical difference in average starting salaries for MBA passout from Business Schools in US by state

the most popular online lead generation automation tool for IT enterprises

THE TOP 10 ONLINE LEAD GENERATION AUTOMATION TOOLS MOST POPULAR IN THE ENTERPRISE SEGMENT |

The list above show the most popular automation and leadfollowing emarketing lead generation marketing automation software's are among the most popular among IT Enterprises. Marketing automation lead generation software's provides a single dashboard tool where marketers can plan and track campaigns, set up their target consumer and audience profile and filter their end result lead generation activity depending on their objectivity in an integrated way without having to use multiple softwares or exporting third party data to find the ROI or efficacy of their online marketing campaigns

In terms of most popular marketing and lead gen automation tool based on the number of users are INFUSIONSOFT, HUBSPOT and TERADATA apimo. In terms of social media folliwung HUBSPOT, MARKETO and SIMPLYCAST lead the number 1 to 3 rank

الأربعاء، 26 أغسطس 2015

top 20 start ups funded by Fidelity investment

The above list prepared and verified by Crunchbase shows the list of total VC funded start ups where Fidelity investments has a stake . From Airbnb, Pinterest, Snapchat , Uber and Hootsuite it is also present across medical and Biotech start ups like Pax labs and Blue Apron

Fidelity Investment has earlier been known for funding many unrelated businesses, including a luxury hotel and Veritude, a temporary employment agency.. Fidelity has also strategically invested in the telecom/managed services/data center industries, having incubated COLT Telecom Group in Europe, MetroRED in South America, and KVH in Japan. (Since 2008, all MetroRED ownership has been completely divested.)Meanwhile Fidelity ventures Fidelity Ventures is its venture capital arm. Fidelity International Limited (FIL), was an affiliate founded in 1969, serving international markets and the rest of the world;

Comparing cloud music services: spotify vs soundcloud

Spotify is a clear leader in the pay for music streaming market,while Soundcloud is a overwhelming favourite across he world .What adds to the popularity of Soundcloud is the fact that it is available worldwide as opposed to Spotify which is present only across a few countries

Traffic and Popularity : In terms of traffic Spotify ranks 336 in Alexa globally, while in US it ranks 163 whileSoundCloud ranks 166 in Alexa globally, while in US it ranks 121. This means Soundcloud is the number one choice for free " music streaming" or music sharing services .Soundcloud is extremely popular in the United States too

SoundCloud is available to global users as compared to Spotify which is available only to

USA, UK, Sweden, Finland, Norway, Denmark, Germany, France, Spain, Austria, Belgium, Switzerland, The Netherlands, Australia, New Zealand, Ireland, Luxembourg, Portugal, Italy, Poland, Mexico, Singapore, Hong Kong, Malaysia, Lithuania, Latvia, Estonia and Iceland.

how startups fund their business : top 5 source of funding

have your post or banner displayed here for $10 a day .Click here to know more

The list of VC funding behind moocs ( massive online open courses ) start up Coursera

List of VC funding and equity Investment in online open education Course start up "Coursera"

|

List of Venture Capital Funding in the massive Open Online Course (MOOC) Coursera. SO far it has managed to generate more than $135million from 5 rounds of Funding Deals |

With a $49.5 million Series C funding round , well known open massive online course start up ( MOOC) online learning start up which conducts open online courses Coursera, concluded its 5th found of VC funding which saw VC deals from Kleiner Perkins Caufield & Byers and International Finance Corporation. Times Internet Limited (TIL), which owns the Times of India and other media properties, also participated in this

Coursera also recently announced that it expects a second closing of this round that will bringits total funding to $60 million. GSV Asset Management and Learn Capital are expected to will participate in this second closing

top 10 most popular online buyer persona research software

The infographic shows a list of research software most popular Project management campaign tools that allows users to create online buyer personas ,allows companies and organizations to track and manage tasks, goals, and teams for projects. The below infographic shows the list of top 10 research and online buyer persona capturing trends.

الثلاثاء، 25 أغسطس 2015

new home and real estate purchases in Unites states to rise 4.5% in next one year

- Home values in the United States are projected to rise by 4.5% over the next 12 months.

- Home values in the United States are expected to rise 4.51% in the next year ( source)

- Market growth may be slowing, as this forecasted growth is less than the 6.5% increase seen over the past 12 month median sale price for homes in the United States is $199,000, up 10.56% over the past 12 months.

BRICS lead Life Insurance premium growth , china growing 3times its nearest competitor

|

Global Insurance Premiums are lead by BRIC Nations with China growing 3 times as much as its nearest BRIC partners |

The 5 most difficult markets for Insurance companies to do business

|

GLOBALLY THE TOP 3 MOST DIFFICULT NATIONS TO INSURANCE BUSINESS ARE A) NIGERIA 2)KENYA AND 3)RUSSIA& Ratings from Transparency International suggest that the RGMs in this study that face the highest levels of risk from perceived corruption are Nigeria, Kenya and Russia: • In Kenya, the state’s ability to enforce anti-fraud regulation is notably weak, although improvements are being made in transparency and accountability Running an Insurance Company in Nigeria has its own set of problems as "fraud in Nigeria is a globally recognized problem. In addition, an environment of limited transparency and accountability fosters “grand corruption” involving well-connected business and political figures. Compared to others, Russia offers a comparatively high level of financial and economic infrastrurucal for insurance business but has faced criticisms on its failure to curb nepotism , and andw its capacity to battle corruption and claims of political influence |

the 20 most innovative fintech companies

worlds Top 20 most Innovative Fintech Companies .

Global fintech financing has more than trebled in the past three years to an estimated US$3 billion annually – and the level of innovation in the financial services sector has been unprecedented over the past 12 months. The level of spend and intensity of changes taking place across" financial technology "focus will – and already has – led to the development and release of products and solutions that will change the way customers view and interact with their financial services providers – forever.

This global list of the "most innovative companies in the world that has been compiled by KPMG along with AWI ventures is based extensively on global research and analysis based on data on specially 4 factors .1total capital raised • rate of capital raising • degree of sub industry disruption • degree of product, service, customer experience and business model innovation (a subjective ranking from each member of the judging panel).

Global fintech financing has more than trebled in the past three years to an estimated US$3 billion annually – and the level of innovation in the financial services sector has been unprecedented over the past 12 months. The level of spend and intensity of changes taking place across" financial technology "focus will – and already has – led to the development and release of products and solutions that will change the way customers view and interact with their financial services providers – forever.

This global list of the "most innovative companies in the world that has been compiled by KPMG along with AWI ventures is based extensively on global research and analysis based on data on specially 4 factors .1total capital raised • rate of capital raising • degree of sub industry disruption • degree of product, service, customer experience and business model innovation (a subjective ranking from each member of the judging panel).

الاثنين، 24 أغسطس 2015

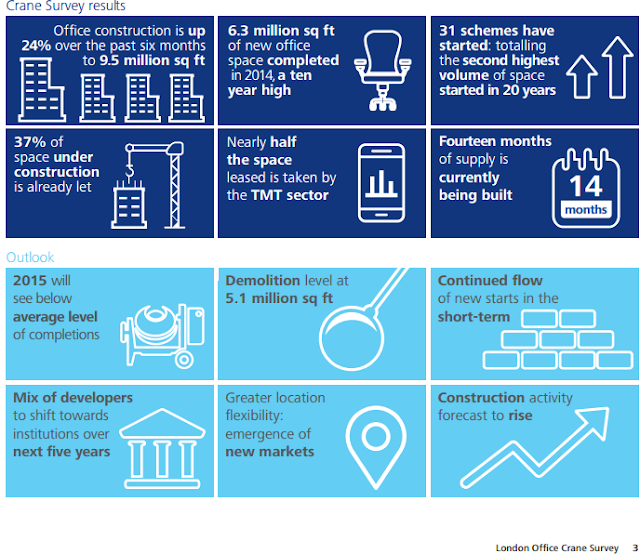

3 industries that are leading real estate office space boom in London

|

The industries that are leading Real estate Office boom in LondonThe latest Deloitte survey on the growth of office space real estate in London shows that corporations continue to invest on real estate office space in a big way.

In 2012, Tech, media and telco made up 12% of real estate occupancy in London for the first three quarters |

Which is a better investment : luxury resorts vs real estate

Luxury Defined: Average number of days a luxury property spent on the market (as of December 31, 2014) (via Christie's International Real Estate).

The most expensive luxury Investments:Real Estates vs Resort Estates

Which would be a better Investment ?Investing in a real estate property in New York, London, Berlin or any other financial capital of the world , versus investing in a real estate property in the metropolitan or a suburb.

Does investing in an upmarket resort hotels for a weekend getaway close to the city be better than a heritage resort with a high proximity to a historical and tourist destination ?The below infographic compares the price points for knowing which would be a better investment

Does investing in an upmarket resort hotels for a weekend getaway close to the city be better than a heritage resort with a high proximity to a historical and tourist destination ?The below infographic compares the price points for knowing which would be a better investment

HOW LUXURY MARKETS ACROSS GLOBAL BUSINESS HUBS DIFFERS

The cost of luxury across primary markets and resorts markets

Luxury Defined: The entry price for luxury homes varies greatly by market, from $750,000 in Durban, South Africa, to $8 million in Beverley Hills. (via Christie's International Real Estate).

الأحد، 23 أغسطس 2015

The global insurance industry risk vs opportunity matrix chart

Where are Insurance companies looking to Invest across the world ? The below report plays out the contrasting studies on the most risky markets that might give unprecedented growth versus the safest countries which might give just predictable business The charts shows a country matrix based on the nations 5 factors which classify them as being the most risky, medium and hottest markets for Insurance and the nations have the most potential in increasing insurance penetration across the world.

GLOBAL INSURANCE MARKETS MATRIX

For most of the past decade, insurance companies focused on investing across BRICS market which was a simple strategy for insurance companies seeking to expand their business in RGMs.

For most of the past decade, insurance companies focused on investing across BRICS market which was a simple strategy for insurance companies seeking to expand their business in RGMs.

According to recent forecasts from Oxford Economics, the average growth rate of real GDP in the BRICs was 4.3% in 2012, and that rate is expected to rebound only modestly, to about 5.6%, between now and 2018. Growth in other RGMs will be affected by this deceleration.

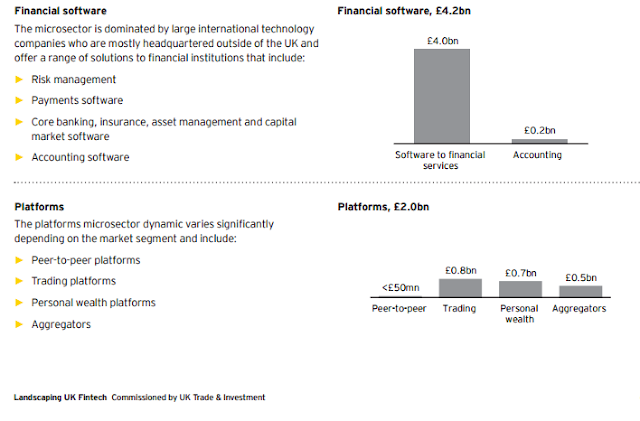

3 charts that show why London is emerging as number one fintech market

The UK is among the most technologically advanced nation in terms has a large and sophisticated consumer base with world leading mobile and internet penetration.That besides UK is among top 3 financial capital of the world. Lonon generates approximately 20 per cent of the UK's GDP while the economy of the London metropolitan area—the largest in Europe—generates approximately 30 per cent of the UK's GDP

The UK is home to over 100 of Europe's 500 largest companies which have their headquarters in London. Over 70 per cent of the FTSE 100 are located within London's metropolitan area, and 75 per cent of Fortune 500 companies have offices in London.The UK market open minded to innovative products from new providers. London is one of the world’s largest financial institutions with 251 foreign banks and 588 foreign quoted companies.

السبت، 22 أغسطس 2015

UK Fintech industry to exceed £20billion ,growing at 18%

|

| FINANCIAL ANALYSIS AND BIG DATA |

The UK Fintech market is worth c. £20bn in annual revenue which is growing at 18% presently. According the latest findings by Ernst and Young ( summarized in chart above ) shows the state of the UK Fintech market sizes across the 4 verticals

The UK Fintech market is worth c. £20bn in annual revenue which is growing at 18% presently. According the latest findings by Ernst and Young ( summarized in chart above ) shows the state of the UK Fintech market sizes across the 4 verticals- Payments Space (c. £10bn),

- Software (c. £4.2bn),

- Data and Analytics (c. £3.8bn) and

- Platforms (c. £2.0bn).

Meanwhile the highest growth areas across Fintch industry has been across peer-to-peer platforms, online payments and the data and analytics products (credit reference, capital markets and insurance) which together represent . 60% of the sector.

the biggest women powered :start ups : Theranos

have your post or banner displayed here for $10 a day .Click here to know more

ELIZABETH HOLMES: The women behind the biggest disruption in the Biotech industry whose personal estimate of wealth stands at $4.5billion and she is just 31, and resides Paulo Alto California

TURNING POINT: Holmes uncle died early due to blood cancer which led to her dropping out of her sophomore year at Stanford University to launch a blood testing firm " THERANOS" a medical diagnostics company

THE BIG IDEA :the 19-year-old chemical engineering major started a company to develop her idea for a hand-held medical device, which read the amount of blood and produce a real-time assessment of how a drug is interacting with the body in just one minute .THERANOS blood testing kit s cheaper and faster besides being more accurate and less painful than other methods and tests, is now available at 41 Theranos labs in Walgreens . Theranos recently received a $400 million from venuture investors

DISRUPTIVE QUOTIENT :Theranos seeks to integrate technology, medical systems and healthcare technology to make medecine and healthcare delivery systems more personalized

VC FUNDING TIMELINE : VC Funding at Theranos has been quite active

ELIZABETH HOLMES: The women behind the biggest disruption in the Biotech industry whose personal estimate of wealth stands at $4.5billion and she is just 31, and resides Paulo Alto California

TURNING POINT: Holmes uncle died early due to blood cancer which led to her dropping out of her sophomore year at Stanford University to launch a blood testing firm " THERANOS" a medical diagnostics company

THE BIG IDEA :the 19-year-old chemical engineering major started a company to develop her idea for a hand-held medical device, which read the amount of blood and produce a real-time assessment of how a drug is interacting with the body in just one minute .THERANOS blood testing kit s cheaper and faster besides being more accurate and less painful than other methods and tests, is now available at 41 Theranos labs in Walgreens . Theranos recently received a $400 million from venuture investors

DISRUPTIVE QUOTIENT :Theranos seeks to integrate technology, medical systems and healthcare technology to make medecine and healthcare delivery systems more personalized

VC FUNDING TIMELINE : VC Funding at Theranos has been quite active

- $45M / Venture Jul 8, 2010

- $32.4M / Series C Nov 17, 2006 Investors: ATA Ventures Continental Ventures Draper Fisher Jurvetson (DFJ) Tako Ventures The Lawrence J. Ellison Revocable Trust

- $9.1M / Series B Feb 21, 2006 Investors: ATA Ventures Draper Fisher Jurvetson (DFJ)

- $5.8M / Series A Feb 11, 2005 Investors: Draper Fisher Jurvetson (DFJ) -

source ; crunchbase/Fortune

الاشتراك في:

التعليقات (Atom)