|

Data from NASSCOM predicts by 2020, India will be home to 11500 startup which would employ 2,50,000 jobs. Currently, India’s has 3,100 startup |

INDIAN START UPS BY CITY AND VC FUNDING ACROSS 3 BIGGEST SECTORS

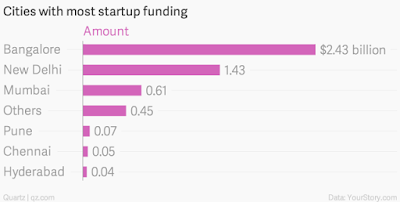

Bangalore accounted for more than 55% of total start up business in India.India's capital and financial centreDelhi and Mumbai were no 2 and 3 . But Bangalore was ahead by miles , when it came to start up ecosystem and VC interest and ease of doing business in the city along withe other intangibles of emerging start up business

Bangalore attracted $2.43 billion (Rs15,189 crore) worth of funding in 2014, of which as much as $1.7 billion was invested in e-commerce. Meanwhile Consumer Internet,mobile apps and ecommerce have emerged as fastest growing start up sectors going by VC interest and the number of deals that has been gone through

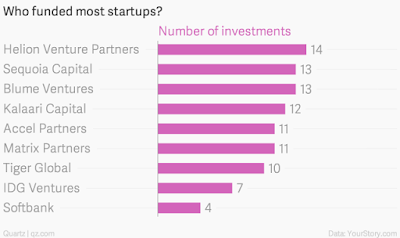

The 3rd chart shows the list of prominent venture capital investors who have invested across Indian start ups.Among them are Helion ventures ,Sequoia Capital, Blume ventures,Kalaari Capital , Accel Partners, Matrix Partners,Tiger Global, IDG ventures, and Softbank who have invested in Indian start ups across diverse sectors such as eCommerce, Online services, Mobility, Enterprise Software and Outsourcing.

Bangalore accounted for more than 55% of total start up business in India.India's capital and financial centreDelhi and Mumbai were no 2 and 3 . But Bangalore was ahead by miles , when it came to start up ecosystem and VC interest and ease of doing business in the city along withe other intangibles of emerging start up business

Bangalore attracted $2.43 billion (Rs15,189 crore) worth of funding in 2014, of which as much as $1.7 billion was invested in e-commerce. Meanwhile Consumer Internet,mobile apps and ecommerce have emerged as fastest growing start up sectors going by VC interest and the number of deals that has been gone through

The 3rd chart shows the list of prominent venture capital investors who have invested across Indian start ups.Among them are Helion ventures ,Sequoia Capital, Blume ventures,Kalaari Capital , Accel Partners, Matrix Partners,Tiger Global, IDG ventures, and Softbank who have invested in Indian start ups across diverse sectors such as eCommerce, Online services, Mobility, Enterprise Software and Outsourcing.

ليست هناك تعليقات:

إرسال تعليق